WhatsApp)

WhatsApp)

quarry equipment,quarry plant,Aggregate Processing Line,- granite quarry block processing ... marble mine in ghana Watch free online video of, Contact supplier. sandstone quarry block cutting machines - CGM Project Case ... dpr formet of marble mines; Exemption From Customs Duty on machinery and equipments, Contact supplier. Prev: pc series ...

Looking for Construction in Ghana? Find the list of best Construction Companies in Ghana on our business directory. ... FBM Marble & Granite is a hardware company that deals in Floor and Wall Tiles, Marbles and Granite, Travertine and Limestone from Italy and Spain. ... Props, Yellow Panel & Beam, Heavy Duty Multi Directional Scaffold, Quick ...

Please find below a table with 10 digit HS tariff codes, import duty & tax rates and any import restrictions for Ornaments of common pottery for 141 countries

HSN codes for mica, stone, cement,asbestos. Posted on 06 January 2019 Category : HSN Codes for GST . ... 6802 23 10 --- Granite blocks or tiles 6802 23 90 --- Other 6802 29 00 -- Other stone ... Travelers to India under import duty exemption, Frequently Asked Questions Part 2.

Foreword. This notice cancels and replaces Notice AGL1 Aggregates Levy dated 4 November 2016. Details of the main changes to the previous version can be found in paragraph 1.2 of this notice.

granite quarry prices india - aardappelpuree. india red granite quarry prices india - Mining equipment mine granite slabs- All granite slabs from, We are exporter of Indian Granite from South India and . Get Price And Support Online; black granite quarry price in karnataka. The Company - Sati Exports India Pvt Ltd - Granite Exporters .

granite quarry mining plan in india for small quarry. granite quarry mining plan in india for small quarry, Quarrying for Indian Desert Cream granite - Aggregates Business . Highly sought-after Desert Cream granite is being extracted from a sprawling 300 hectare mining site .

The exporter shall inform the jurisdictional Custom Officer of the rank of Superintendent or Appraiser of Customs, at least 15 days before the first planned movement of a consignment from his factory/premises, about the intention to follow self-sealing procedure to export goods from the factory premises or warehouse. The jurisdictional . Read More

Ghana's premier resource for news, sports, business, opinions and entertainment. ... Import Duty Information & Facts Internet Service Providers Internet/Cybernet Cafes J Job openings

The customs in Ghana allows some goods and services as well as some specific groups of importers to enjoy some amount of import duty exemptions. The reasons among others could include the necessity or importance labeled or associated with such goods or organizations.

- Free duty calculator for your site ... * According to DutyCalculator calculations Duty categories. ... PB Global Trade Solutions covers over 1,225,056 products for 141 import countries for 281,784 customers. Country guides Trending import items Calculator for eBay items Data updates. About us Terms

The Nigerian Customs Service, NCS, had a couple of weeks ago, raised an alarm that import waivers and duty exemptions granted by the federal government, put at N603 billion between January and ...

Marble and Granite Industry: Issues in the implementation of Goods and Services Tax ... Customs and central excise 12) Service tax 13) Taxes on fuel 14) Electricity duty 4.2 Exemptions/concessions Since the EOU route in the case of integrated units has been a preferred option,

The import duty rate for importing Marble tile into United States is 4.9% plus an excise fee of 0%, this includes Anti Dumping Duty of 25%, because the product is manufactured in China, when classified under Industrial Materials & Supplies → Minerals & Mineral Products → Marble Stone | for wall and flooring with HS commodity code 6802.91.1500. . Additional taxes apply: Merchandise Proce

November 8, 1999 1 These and other import and tax collection numbers are based on a preliminary analysis of ASYCUDA data for 1998 provided by the Ministry of Trade and Industry. Ghana's Trade Policies: Exemptions from Import Duty 1. Introduction About 40 percent of imports officially cleared through Customs in Ghana are exempted from import

Import tax Between 0% and 20% (depending on the type of material and equipment ... Capital gains that result from merger and acquisition activity (in particular the transfer of shares) may be exempt from corporate tax under certain conditions. ... and quarry substances and products.

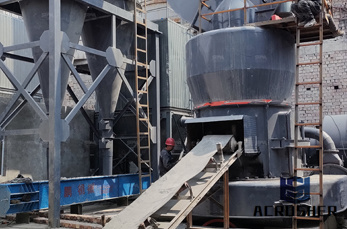

Establishment of a quarry The project is towards the establishment of a quarry operation on a 54acre land at Tetekasum in Suhum and will involve the acquisition of relevant machinery such as crushers, crawler drills, wheel loader and dumper truck.

PwC Corporate income taxes, mining royalties and other mining taxes—2012 update 3 as "ring fencing". The Ghana government, in the 2012 Budget Statement, proposed an increase to the corporate income tax rate from 25% to 35% and an additional tax of 10% on mining companies. Ghana's proposed tax increases are likely to take

Dec 03, 2018· Ghana currently uses the Harmonized System (HS) Customs Code to classify goods. Taxes that are assessed on the basis of weight, value or volume are subject to change annually. Goods arriving in the country may be subject to import duty, Value Added Tax (VAT), special tax and import excise duty. Duties are imposed on certain categories of ...

NB: The Import Duty exemption on fish caught by Ghanaian owned vessels and canoes within the EEZ (Exclusive Economic Zone) and fish from ECOWAS territorial waters remains unchanged. In addition to this 5% import duty is now levied on materials for the manufacture of or prospecting for timber and other natural products. TEN (10) PERCENT RATE

Mining contractors,quarry operators or quarried products,quarry plant or equipment,quarry search or browse our list of mine and quarry services, nonmetallic mining and quarry companies in abuja lant and machinery for sand current import duty. READ MORE; Operating A Granite Quarry In Nigeria

Mining Companies in Ghana. List of Best Mining Companies in Ghana with Addresses, Phone numbers, Reviews, Photos and More on Ghana Business Directory. Page 4.

Ghana imports mostly industrial supplies, capital, consumer goods and foodstuffs. ... The Import Duty exemption on fish caught by ... reduction in vehicle income tax for articulated trucks from 1 ...

The import duty rate for importing Gold bar into United . The import duty rate for Gold bar is 0%. Import port fee (US$50.31 Import port fee if weight more 50 kg per shipment) Italy: 7108.13.1000: Exporting from/to Ghana | Commerce Ghana. Explains the process and costs of exporting goods and items from Ghana.

WhatsApp)

WhatsApp)